Books:

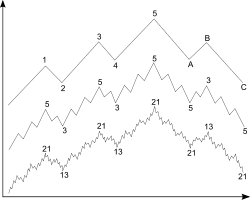

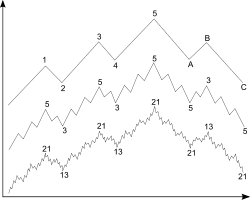

Elliott Wave Principle: Key to Market Behavior

The Wave Principle of Human Social Behavior and the New Science of Socionomics

Articles:

An Introduction to the Elliott Wave Principle – Jordan Kotick

Multi-classifier based on Elliott wave’s recognition

Fuzzy time-series based on Fibonacci sequence for stock price forecasting

Elliott Wave Theory and neuro-fuzzy systems, in stock market prediction: The WASP system

Unconscious Herding Behavior as the Psychological Basis of Financial Market Trends and Patterns

Videos: