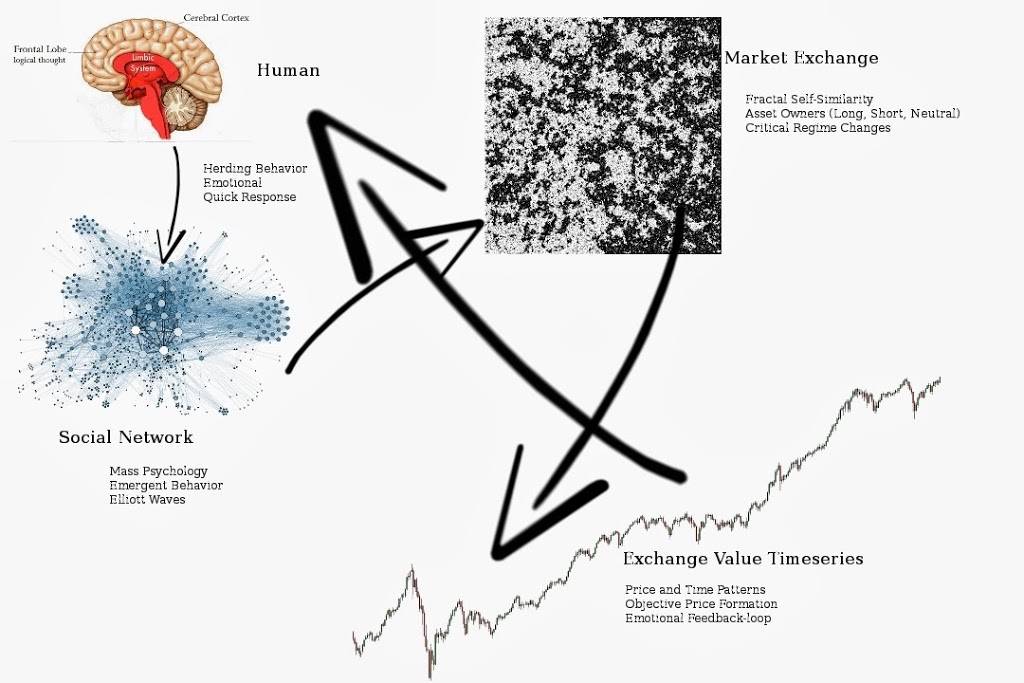

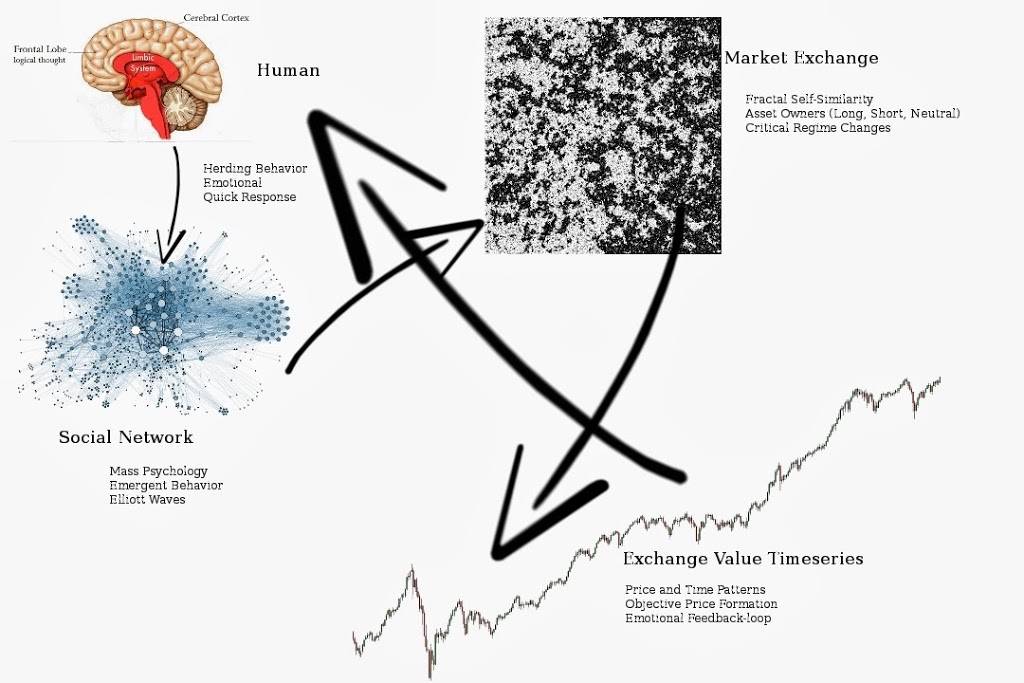

I think that live price data is important, however, there are far more important numbers to be recorded in a financial market. Live data such as: current number of shares long; current number short; size of investor gain (or another measure to see how long a specific investor has been holding his/her position), etc.

Price can change in a matter of micro-seconds; in the 1930’s this observational task would have been deemed impossible — keeping track of such rapid price changes. Now, computers allow humans to do this with ease. What is preventing society from recording and publicly displaying other data in rapid manner. In other words, can we not use our computers to observe the ubiquitous “invisible hand” of market exchange?

I can only imagine visualizing this data analogously with the video showing flights traveling around the world:

Now, imagine that all the flights leaving Europe are people exiting (shorting or selling) an asset. And imagine that all the flights entering Europe are people buying the asset. Obviously, some issues since # of buyers == # of sellers in real market.