To me, the idea of infinite memory processes is one of the most important concepts touched on by Mandelbrot in this book. It suggests that economists and traders should be developing models and theories which value the importance of price series and data going back decades. And it makes sense to me that people and prices do not change their fundamental behavior over extended periods of technological evolution. However, I suspect that organisms do change their fundamental behavior if the time horizon is thousands or millions of years. I am very curious to read more about Hurst’s studies of the Nile.

Category: wave theory

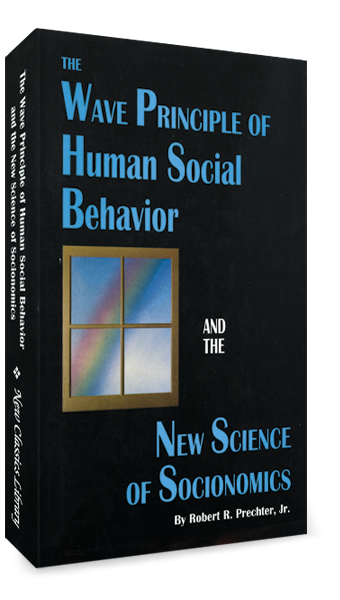

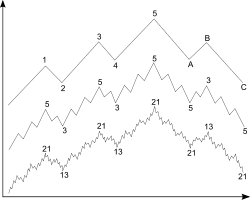

I posted before about the Elliott Wave Principle and several books dealing with the subject. However, I feel the need to reiterate the importance of two books by Robert R. Prechter, Jr. They are: The Wave Principle of Human Social Behavior and Pioneering Studies in Socionomics. I purchased both these books in a two volume collection called, Socionomics: The Science of History and Social Prediction. In all my studies as an undergraduate and graduate student in the field of finance and mathematics, not one professor has ever mentioned Prechter or Elliott.

Books:

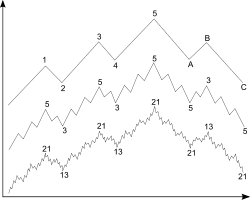

Elliott Wave Principle: Key to Market Behavior

The Wave Principle of Human Social Behavior and the New Science of Socionomics

Articles:

An Introduction to the Elliott Wave Principle – Jordan Kotick

Multi-classifier based on Elliott wave’s recognition

Fuzzy time-series based on Fibonacci sequence for stock price forecasting

Elliott Wave Theory and neuro-fuzzy systems, in stock market prediction: The WASP system

Unconscious Herding Behavior as the Psychological Basis of Financial Market Trends and Patterns

Videos: