John Bogle on Investing: The First 50 Years provides a good insight into the mind of John Bogle, the founder of The Vanguard Group. The only book I have read by Bogle, it explains in detail his belief that individual stock picking is not worth the effort. Instead, Bogle argues that the variance of the return on a total market index decreases as an investor considers a longer time horizon. In other words, the fifteen year return will tend to converge toward the fifteen year average return. A more detailed explanation is provided in the book. This approach suggests that the best strategy would be to invest in a low expense fund that follows either the S&P 500, the Wilshire 5000, or some market index. (ISBN-13: 978-0071761031)

Search

Recent Posts

-

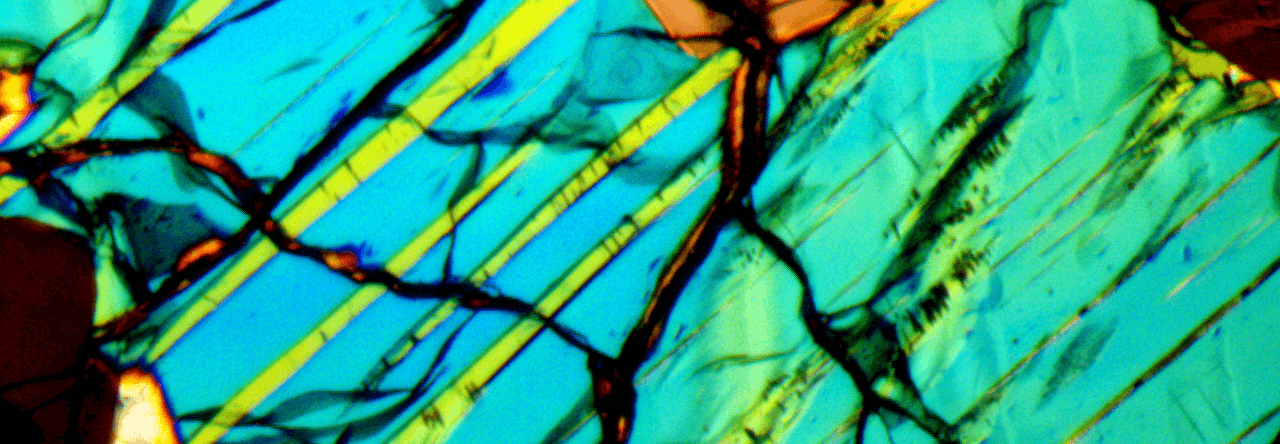

The Meteorite (Chondrite) and its Organisms – Otto Hahn

October 12, 2019

-

Evolution from Space – Fred Hoyle and Chandra Wickramasinghe

May 28, 2019

-

From Virus to Cosmology – Fred Hoyle

January 9, 2019

-

Massive Crater and Younger Dryas

January 2, 2019

-

Microfossils and Biomolecules in Meteorites – Dr. Richard B. Hoover

November 12, 2018

-

Casual Randall Carlson

September 20, 2018

-

Daniel Sheehan

September 8, 2018

-

Dunbar’s Law and Economic Relationships

August 12, 2018

-

Scale – Geoffrey West

August 12, 2018

-

Mastering Bitcoin – Andreas M. Antonopoulos

August 12, 2018